Finance Minister Arun Jaitley will today formally launch the Pradhan Mantri Vaya Vandana Yojana (PMVVY), or a pension scheme, for senior citizens today Friday July 21,2017

Prime Minister Narendra Modi had earlier announced the launch of the scheme exclusively for the senior citizens aged 60 years and above.

Under this scheme, senior citizens (60 years and above) in which they will get a guaranteed interest of 8 per cent for 10 years.

Financial planners say that this pension scheme will offer more avenues to senior citizens to earn steady regular income at a time of falling interest rates.

LIC or Life Insurance Corporation of India operated this scheme.

The scheme is exempted from GST or goods and services tax.

10 things To Know About Pradhan Mantri Vaya Vandana Yojana:

1) LIC started offering the scheme from May 4, 2017. The scheme will remain open till May 3, 2017. The shortfall owing to the difference between the interest guaranteed and the actual interest earned and the expenses relating to administration shall be subsidised by the government of India and reimbursed to the LIC.

2) PMVVY can be purchased offline as well as online through Life Insurance Corporation (LIC) of India which has been given the sole privilege to operate this scheme.

3) The scheme will provide an assured return of 8 per cent per annum payable monthly (equivalent to 8.30 per cent per annum) for 10 years.

4) The pension is payable at the end of each period, during the policy term of 10 years, as per the frequency of monthly/ quarterly/ half-yearly/ yearly as chosen by the pensioner at the time of purchase.

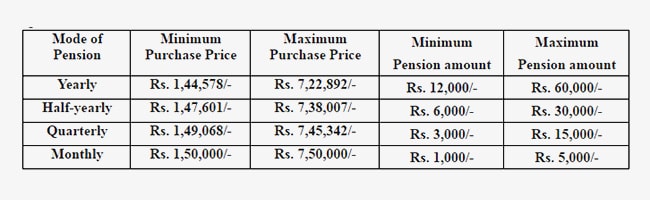

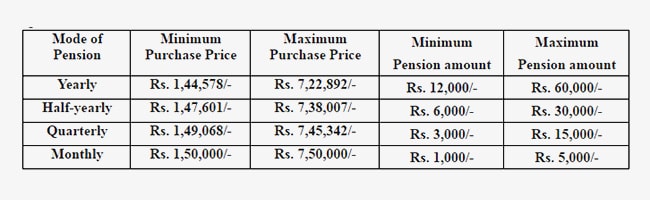

5) There is a minimum and maximum limit for investment in Pradhan Mantri Vaya Vandana Yojana Scheme. The amount varies according to the pension payment mode chosen. For example, under the yearly pension mode, the minimum amount that has to be invested in the scheme is Rs. 1,44,578 and the maximum at Rs. 7,22,892. In monthly mode, the minimum amount that has to be invested is Rs. 1,50,000 and maximum at Rs. 7,50,000. For other modes, see the table below.

Prime Minister Narendra Modi had earlier announced the launch of the scheme exclusively for the senior citizens aged 60 years and above.

Under this scheme, senior citizens (60 years and above) in which they will get a guaranteed interest of 8 per cent for 10 years.

Financial planners say that this pension scheme will offer more avenues to senior citizens to earn steady regular income at a time of falling interest rates.

LIC or Life Insurance Corporation of India operated this scheme.

The scheme is exempted from GST or goods and services tax.

10 things To Know About Pradhan Mantri Vaya Vandana Yojana:

1) LIC started offering the scheme from May 4, 2017. The scheme will remain open till May 3, 2017. The shortfall owing to the difference between the interest guaranteed and the actual interest earned and the expenses relating to administration shall be subsidised by the government of India and reimbursed to the LIC.

3) The scheme will provide an assured return of 8 per cent per annum payable monthly (equivalent to 8.30 per cent per annum) for 10 years.

4) The pension is payable at the end of each period, during the policy term of 10 years, as per the frequency of monthly/ quarterly/ half-yearly/ yearly as chosen by the pensioner at the time of purchase.

5) There is a minimum and maximum limit for investment in Pradhan Mantri Vaya Vandana Yojana Scheme. The amount varies according to the pension payment mode chosen. For example, under the yearly pension mode, the minimum amount that has to be invested in the scheme is Rs. 1,44,578 and the maximum at Rs. 7,22,892. In monthly mode, the minimum amount that has to be invested is Rs. 1,50,000 and maximum at Rs. 7,50,000. For other modes, see the table below.

Accordingly, Rs. 1,000 will be the minimum pension amount payable monthly for which Rs.1,50,000 has to be invested. Similarly, the maximum monthly pension shall be Rs. 5,000 per month for which Rs. 7,50,000 has to be invested. For other modes, see the table above. (It should be noted that the ceiling of maximum pension - pensioner, his/her spouse and dependants - is for a family as a whole.)

6) On survival of the pensioner to the end of the policy term of 10 years, purchase price along with final pension instalment shall be payable.

7) Loan up to 75 per cent of purchase price (amount invested to earn pension) shall be allowed after three policy years to meet the liquidity needs. Loan interest shall be recovered from the pension installments and the loan to be recovered from claim proceeds.

8) The scheme also allows for premature exit for the treatment of any critical/ terminal illness of self or spouse. On such premature exit, 98 per cent of the purchase price shall be refunded.

9) On death of the pensioner during the policy term of 10 years, the purchase price shall be paid to the beneficiary.

10) Manoj Nagpal, CEO of Outlook Asia, says senior citizens should take advantage of PMVVY pension scheme as well as another popular senior citizens scheme called Senior Citizen Savings Scheme (SCSS). "If one has to choose one over the other, then the PMVVY is better as one has a longer time frame need of 10 years while the SCSS is better for higher liquidity it provides," he says. Though the interest earned from both the schemes are taxable, effective tax planning and higher tax slabs can greatly reduce the impact of tax for senior citizens, he adds.

6) On survival of the pensioner to the end of the policy term of 10 years, purchase price along with final pension instalment shall be payable.

7) Loan up to 75 per cent of purchase price (amount invested to earn pension) shall be allowed after three policy years to meet the liquidity needs. Loan interest shall be recovered from the pension installments and the loan to be recovered from claim proceeds.

8) The scheme also allows for premature exit for the treatment of any critical/ terminal illness of self or spouse. On such premature exit, 98 per cent of the purchase price shall be refunded.

9) On death of the pensioner during the policy term of 10 years, the purchase price shall be paid to the beneficiary.

10) Manoj Nagpal, CEO of Outlook Asia, says senior citizens should take advantage of PMVVY pension scheme as well as another popular senior citizens scheme called Senior Citizen Savings Scheme (SCSS). "If one has to choose one over the other, then the PMVVY is better as one has a longer time frame need of 10 years while the SCSS is better for higher liquidity it provides," he says. Though the interest earned from both the schemes are taxable, effective tax planning and higher tax slabs can greatly reduce the impact of tax for senior citizens, he adds.

No comments:

Post a Comment