''MUDRA Bank'' will provide credit of up to Rs 10 lakh to small entrepreneurs and act as a regulator for 'Micro-Finance Institutions' (MFIs)

The roles envisaged for MUDRA include laying down policy guidelines for micro enterprise financing business and registration of MFI entities as well as their accreditation and rating.

There are about 5.77 crore small business units. It will also lay down "responsible financing practices" to ward off over indebtedness and ensure proper client protection principles and methods of recovery, besides development of standardised set of covenants governing last mile lending to micro enterprises.

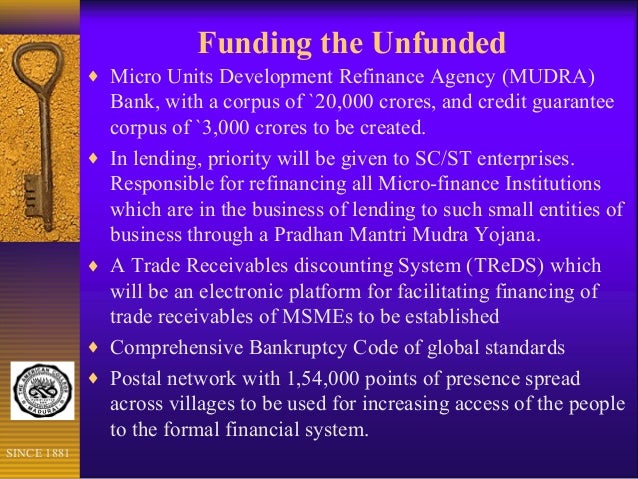

In his 2015-16 Budget speech, Finance Minister Arun Jaitley had proposed the Micro Units Development Refinance Agency (MUDRA) with a corpus of Rs 20,000 crore, and credit guarantee corpus of Rs 3,000 crore

Shishu would cover loans up to Rs 50,000 while Kishor above Rs 50,000 and up to Rs 5 lakh

Tarun category will cover loans of above Rs 5 lakh and upto Rs 10 lakh

No comments:

Post a Comment