The income tax department has urged taxpayers to link Aadhaar with PAN immediately. This will be useful for e-verification of income tax returns using OTP (one-time password) sent to their mobile registered with Aadhaar, the tax department said. In this regard, the income tax department has launched an online facility to link Aadhaar with PAN, In case of any minor mismatch in Aadhaar name provided by taxpayer when compared to the actual data in Aadhaar, One Time Password (Aadhaar OTP) will be sent to the mobile registered with Aadhaar. In rare cases where Aadhaar name is completely different from name in PAN, then the linking will fail and taxpayer will be prompted to change the name in either Aadhaar or in PAN database, the tax department said. For the benefit of taxpayers, the income tax department has launched an online facility to correct errors in names and other details in permanent account number (PAN) and Aadhaar document.

Here are 5 things to know:

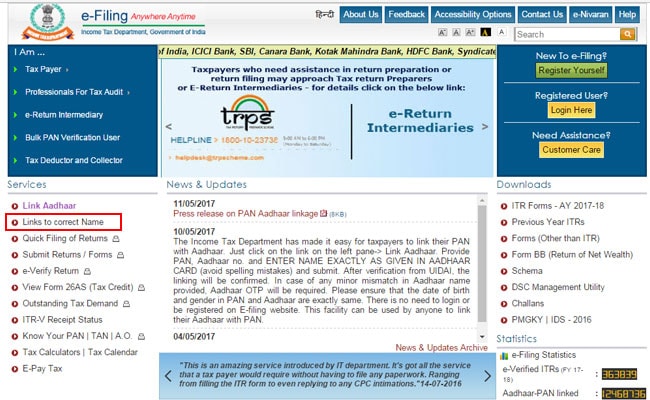

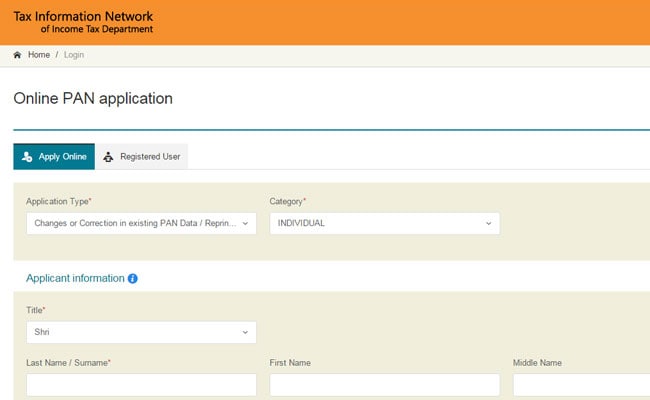

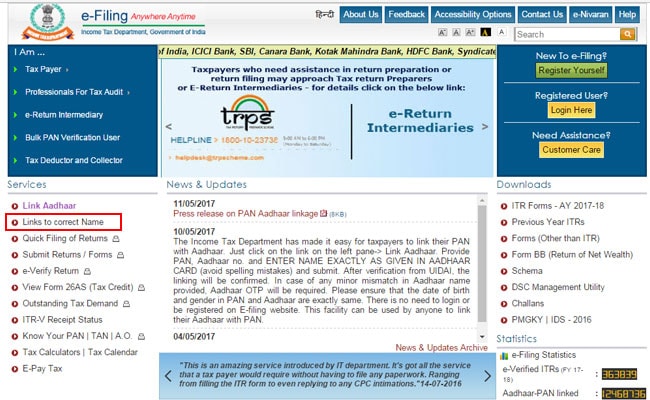

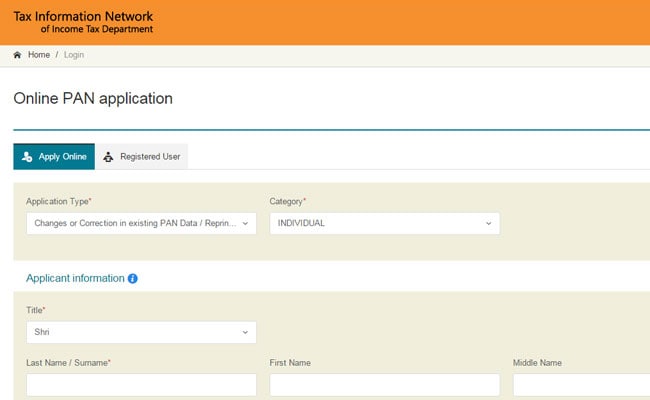

1) Alongside the facility to link biometric identifier Aadhaar with PAN, the department has also put two separate hyperlinks on its e-filing website - https://incometaxindiaefiling.gov.in/ - one to update changes in existing PAN data or for application of new PAN by an Indian or a foreign citizen.

Source: https://incometaxindiaefiling.gov.in/

Source: https://www.onlineservices.nsdl.com/paam

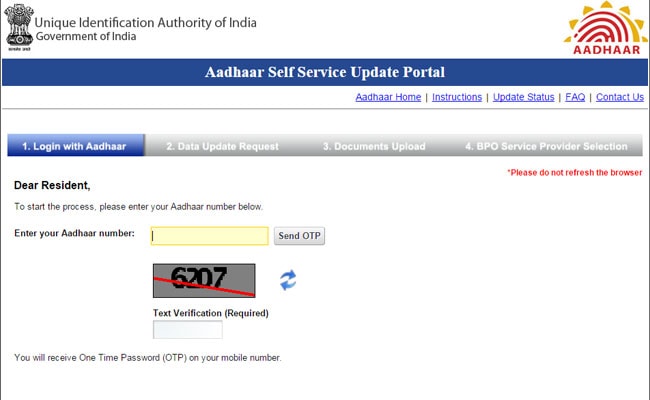

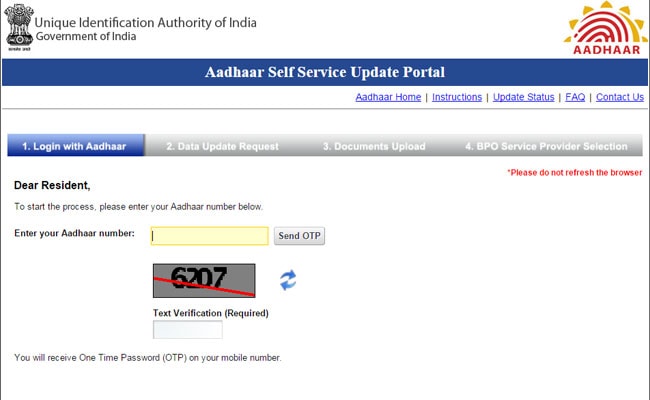

2) The second hyperlink is for individuals who want to update Aadhaar details by logging into 'Aadhaar Self Service Update Portal' using the unique identity number. The individual can then upload scanned documents as proof for correcting data.

3) The income tax department's e-filing website - incometaxindiaefiling.gov.in - has a new link on its homepage for connecting Aadhaar with PAN of a taxpayer.

4) There is no need to log in or be registered on e-filing website of the income tax department. This facility can be used by anyone to link their Aadhaar with PAN.

4) There is no need to log in or be registered on e-filing website of the income tax department. This facility can be used by anyone to link their Aadhaar with PAN.

5) The link requires a person to key in his or her PAN number, Aadhaar number and the "exact" name as mentioned on the Aadhaar card. After verification from the UIDAI (Unique Identification Authority of India), the linking will be confirmed. The government, under the Finance Act 2017, has made it mandatory for taxpayers to quote Aadhaar or enrolment ID of Aadhaar application form for filing income tax returns (ITR). Also, Aadhaar has been made mandatory for applying for PAN or permanent account number with effect from July 1, 2017.

Here are 5 things to know:

1) Alongside the facility to link biometric identifier Aadhaar with PAN, the department has also put two separate hyperlinks on its e-filing website - https://incometaxindiaefiling.gov.in/ - one to update changes in existing PAN data or for application of new PAN by an Indian or a foreign citizen.

Source: https://incometaxindiaefiling.gov.in/

Source: https://www.onlineservices.nsdl.com/paam

2) The second hyperlink is for individuals who want to update Aadhaar details by logging into 'Aadhaar Self Service Update Portal' using the unique identity number. The individual can then upload scanned documents as proof for correcting data.

3) The income tax department's e-filing website - incometaxindiaefiling.gov.in - has a new link on its homepage for connecting Aadhaar with PAN of a taxpayer.

5) The link requires a person to key in his or her PAN number, Aadhaar number and the "exact" name as mentioned on the Aadhaar card. After verification from the UIDAI (Unique Identification Authority of India), the linking will be confirmed. The government, under the Finance Act 2017, has made it mandatory for taxpayers to quote Aadhaar or enrolment ID of Aadhaar application form for filing income tax returns (ITR). Also, Aadhaar has been made mandatory for applying for PAN or permanent account number with effect from July 1, 2017.

No comments:

Post a Comment