29 state-owned banks wrote off a total of Rs 1.14 lakh crore of bad

debts between financial years 2013 and 2015, much more than they had

done in the preceding nine years.

In response to an RTI application filed, the RBI disclosed that while bad debts stood at Rs 15,551 crore for the financial year ending March 2012, they had shot up by over three times to Rs 52,542 crore by the end of March 2015.

Asked about the details of the biggest defaulters, whether

individuals or business entities, whose bad debts to the tune of Rs 100

crore or more had been written off, the RBI said: “The required

information is not available with us.” Banks are required to report the

bad debts on a consolidated basis, it said.

Even as the government has been trying to shore up public sector banks through equity capital and other measures, bad loans written off by them between 2004 and 2015 amount to more than Rs 2.11 lakh crore. More than half such loans (Rs 1,14,182 crore) have been waived off between 2013 and 2015.

Only two banks, State Bank of Saurashtra and State Bank of Indore, have shown zero bad debts in the past five years.

In other words, while bad loans of public-sector banks grew at a rate of 4 per cent between 2004 and 2012, in financial years 2013 to 2015, they rose at almost 60 per cent. The bad debts written off in financial year ending March 2015 make up 85 per cent of such loans since 2013.

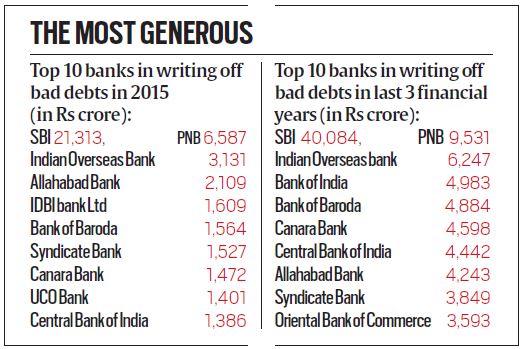

Bank-wise break-up shows State Bank of India, India’s largest bank,

is way ahead of others in declaring loans as unrecoverable, with its bad

debts shooting up almost four times since 2013 — from Rs 5,594 crore in

2013 to Rs 21,313 crore in 2015.

In fact, SBI’s bad debts made up 40 per cent of the total amount written off by all other banks in 2015 and were more than what 20 other banks wrote off. In 2014 too, the bank’s bad debts alone comprised 38 per cent of the total of all banks. The figure of bad loans for 2014 and ‘15 combined, Rs 34,490 crore, was Rs 10,000 crore more than that for between 2004 and 2013, Rs 23,992 crore.

The country’s second-largest public sector bank, Punjab National Bank, has also witnessed a consistent rise in bad debts since 2013. These grew by 95 per cent between 2013 and 2014 but climbed by 238 per cent between 2014 and 2015 — from Rs 1,947 crore in 2014 to Rs 6,587 crore in 2015.

In response to an RTI application filed, the RBI disclosed that while bad debts stood at Rs 15,551 crore for the financial year ending March 2012, they had shot up by over three times to Rs 52,542 crore by the end of March 2015.

Even as the government has been trying to shore up public sector banks through equity capital and other measures, bad loans written off by them between 2004 and 2015 amount to more than Rs 2.11 lakh crore. More than half such loans (Rs 1,14,182 crore) have been waived off between 2013 and 2015.

Only two banks, State Bank of Saurashtra and State Bank of Indore, have shown zero bad debts in the past five years.

In other words, while bad loans of public-sector banks grew at a rate of 4 per cent between 2004 and 2012, in financial years 2013 to 2015, they rose at almost 60 per cent. The bad debts written off in financial year ending March 2015 make up 85 per cent of such loans since 2013.

In fact, SBI’s bad debts made up 40 per cent of the total amount written off by all other banks in 2015 and were more than what 20 other banks wrote off. In 2014 too, the bank’s bad debts alone comprised 38 per cent of the total of all banks. The figure of bad loans for 2014 and ‘15 combined, Rs 34,490 crore, was Rs 10,000 crore more than that for between 2004 and 2013, Rs 23,992 crore.

The country’s second-largest public sector bank, Punjab National Bank, has also witnessed a consistent rise in bad debts since 2013. These grew by 95 per cent between 2013 and 2014 but climbed by 238 per cent between 2014 and 2015 — from Rs 1,947 crore in 2014 to Rs 6,587 crore in 2015.

No comments:

Post a Comment