What is gold monetisation scheme?

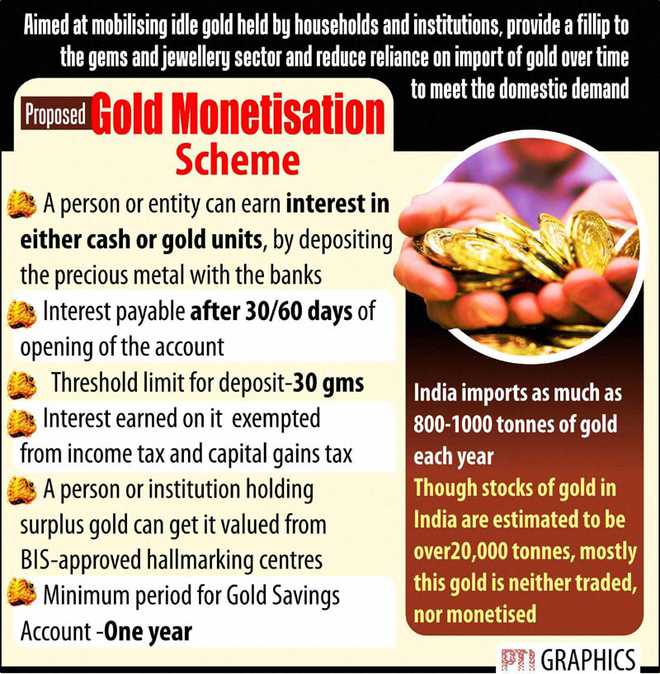

It is a scheme that facilitates the depositors of gold to earn interest

on their metal accounts. Once the gold is deposited in metal account, it

will start earning interest on the same.

How it generally works?

When a customer brings in gold to the counter of specified agency or

bank, the purity of gold is determined and exact quantity of gold is

credited in the metal account. Customers may be asked to complete KYC

(know-your-customer) process. The deposited gold will be lent by banks

to jewellers at an interest rate little higher than the interest paid to

customer.

How is the interest rate calculated?

Both principal and interest to be paid to the depositors of gold, will

be ‘valued’ in gold. For example if a customer deposits 100 gm of gold

and gets one per cent interest, then, on maturity he has a credit of 101

gram.

The interest rate is decided by the banks concerned.

What is the tenure?

The tenure of gold deposits is likely to be for a minimum of one year.

The minimum quantity of deposits is pegged at 30 gram to encourage even

small deposits. The gold can be in any form, bullion or jewellery.

How the redemption takes place?

Customer will have the choice to take cash or gold on redemption, but the preference has to be stated at the time of deposit

Note

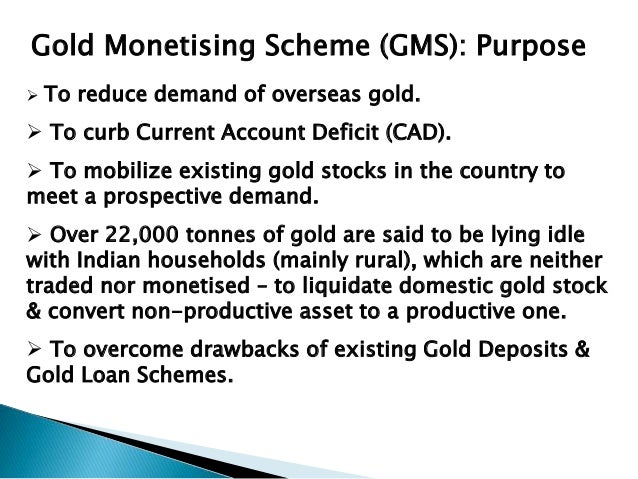

While announcing several steps for monetising gold in his Budget

2015-16, Union Finance Minister Arun Jaitley stated that stocks of gold

in India were estimated to be over 20,000 tonnes but mostly this gold

was neither traded, nor monetised.

Finance Minister Arun Jaitley proposed a Gold Monetisation Scheme, which would replace

both the present Gold Deposit and Gold Metal Loan Schemes. He said the

new scheme would allow the depositors of gold to earn interest in their

metal accounts and the jewellers to obtain loans in their metal account.

Banks/ other dealers would also be able to monetise this gold.

The Finance Minister Arun Jaitley also announced the development of an alternate

financial asset, a Sovereign Gold Bond, as an alternative to purchasing

metal gold. The bonds would carry a fixed rate of interest, and also be

redeemable in terms of the face value of the gold, at the time of

redemption by the holder of the bond.

No comments:

Post a Comment