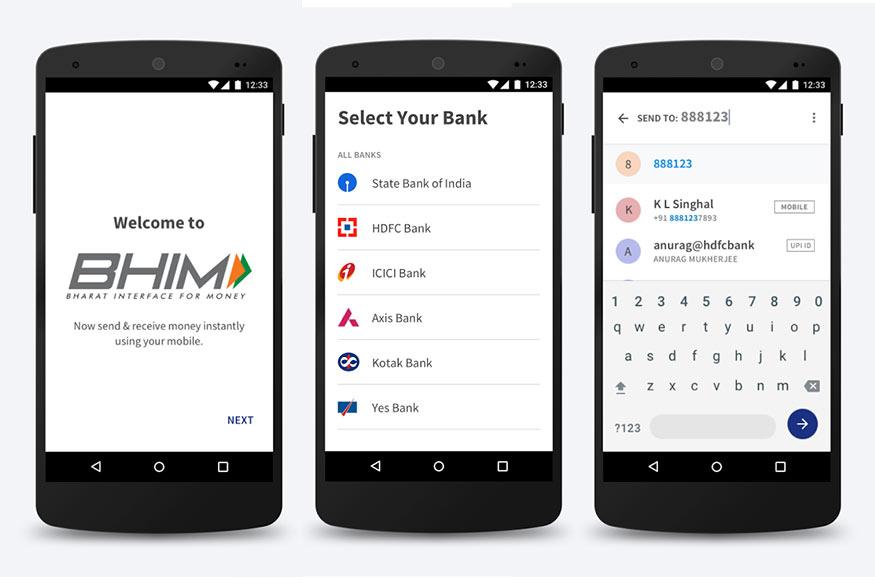

Prime Minister Narendra Modi on Friday Dec 30,2016 launched a new mobile app called BHIM to enable fast, secure and reliable payments system that uses smartphones for cashless transactions.

The application has been named after Dalit icon Bhim Rao Ambedkar.

BHIM, short for Bharat Interface for Money, can be used with other Unified Payment Interface (UPI) applications and bank accounts.

To use it, one needs to download the app from an App store and register their bank accounts and set up a UPI pin for the account.

The mobile number is the payment address and one can start transactions immediately.

The new app is expected to minimise the role of plastic cards and point of sale machines.

The app will eliminate fee payments for service providers like MasterCard and Visa, which has been a stumbling block in people switching to digital payments.

The app can be used to send and receive money through smartphones.

Money can also be sent to non UPI supported banks.

Bank balance can also be checked through the app.

Currently Hindi and English are supported in the app, with more languages coming soon.

Indicating the e-wallet app will feature fingerprint verification in future, PM Modi said: "Only your thumb will be needed to make a payment. Your thumb will be your bank."

What is BHIM?

BHIM is short for Bharat Interface for Money. It is a money transfer app based on UPI for Android phones.

What is UPI?

UPI stands for United Payment Interface. Money can be transferred to individuals to their bank accounts within seconds. The money transfer takes place via IMPS. The advantage here is that there is no need for either the person transferring the amount or the recipient to know the bank details or mobile number. The receipt and transfer takes places on the basis of a Virtual Payment Address (VPA). The VPA looks something like xxxx@icici. Almost all the banks under UPI have their UPI apps or have integrated UPI into their existing apps.

So why BHIM?

BHIM is a single app that can be used with any bank. The VPA – across all banks – ends with @UPI. For example XXXX@UPI

Where do I get the BHIM app?

From the Google Play Store. https://goo.gl/wSsd5h

The Play store is for Android. I have an iPhone.

The app is only available on Android as of now. Support for iOS, Windows Phone and BlackBerry may arrive soon.

Okay. Downloaded. Now what?

Open the app and enter your mobile number. It will store your mobile number and verify it. Next, you have to select the bank in which you have an account. The app will once again search the bank’s account linked to your mobile number and display it. If the account number is correct, select it. The account will now be linked to the app. You will be given a default VPA <yourmobilenumber>@UPI. You can also set your unique ID (your name), subject to availability. You will be shown a QR code, which you can store or print. You will also be asked to set a pin code for security.

How do I transfer money?

There are multiple ways to do so.

The first is to transfer via mobile number or UPI ID

1. Enter the mobile number or UPI ID of the recipient.

2. Enter the amount.

3. You will be asked to enter your PIN

4. The amount will be transferred immediately.

The second is to transfer using QR code

1. Scan the QR code in the mobile of the recipient or a print out of the code.

2. Enter the amount

3. It will ask for your PIN

4. The amount will be transferred immediately.

Can I request money?

Yes, you can request money from other BHIM users through the app. For this, you have to open the ‘Request’ link and mention the UPI ID or mobile number. You can also time the validity of your request. The sender will be asked to enter their PIN before transferring the amount.

The person I want to transfer money to does not have an UPI VPA. What do I do?

In the Send Money option, click on the three dots on the top right. You will get an option that says ‘ACCOUNT+IFSC’. You will be able to transfer the money based on account number and IFSC code of the recipient.

Can I transfer any amount?

No. It is limited to ₹10,000 per transaction and ₹20,000 within 24 hours.

Can I add multiple accounts?

Yes, and No.

You can add multiple accounts. But only one account can be used at a time. Even if you switch accounts, your VPA will be the same.

Can I transfer money to other wallets from BHIM?

No, this feature is not available on the app.

I don’t have a phone. Can I use BHIM through my computer?

No. An Android phone with internet connectivity is a MUST for the BHIM app.

Must the recipient have a mobile?

No. There is no need for the recipient to have a mobile. It will be credited directly to the recipient’s account. However, the recipient must have a VPA. If not, money can transferred using the recipient’s account number and IFSC code.

What are the advantages over other UPI apps?

The VPA is simpler. The VPA for each bank is different. For example, if you have an account in ICICI, the VPA will be xxxxx@ICICI. For a HDFC Bank account holder, it will be xxxx@HDFC. BHIM eliminates all these different IDs. All BHIM VPAs end with xxxx@UPI. Also, most UPI apps of banks don’t have QR codes, while BHIM has that option.

What are the advantages over other wallets like Paytm or Mobikwik?

In other wallets, you have to store money in the wallet. You are blocking your money by storing money in the mobile wallets and you are losing interest. But in BHIM, the amount stays in your bank till you transfer. Also, when someone transfers money, you will get it in your account.

All you need to know about the BHIM App

* Bharat Interface for Money (BHIM) is an initiative to enable fast, secure and reliable cashless payments through your mobile phone

* BHIM is interoperable with other unified payment interface (UPI) applications, and bank accounts.

* BHIM is developed by the National Payment Corporation of India (NPCI).

HOW IT WORKS

*Register your bank account with BHIM, and set a UPI pin for the account.

* Your mobile number is your payment address (PA), and you can simply start transacting.

* Send and receive money: Send money to or receive money from friends, family and customers through a mobile number or payment address. Money can also be sent to non-UPI supported banks using IFSC and MMID. You can also collect money by sending a request and reverse payments if required.

* Check balance: You can check your bank balance and transactions details on the go.

* Custom payment address: You can create a custom payment address in addition to your phone number.

* QR code: You can scan a QR code for faster entry of payment addresses. Merchants can easily print their QR code for display.

* Transaction limits: Maximum of Rs 10,000 per transaction and Rs 20,000 within 24 hours.

* Language supported: Hindi and English. More languages coming soon!

* Supported banks: Allahabad Bank, Andhra Bank, Axis Bank, Bank of Baroda, Bank of India, Bank of Maharashtra, Canara Bank, Catholic Syrian Bank, Central Bank of India, DCB Bank, Dena Bank, Federal Bank, HDFC Bank, ICICI Bank, IDBI Bank, IDFC Bank, Indian Bank, Indian Overseas Bank, Indusind Bank, Karnataka Bank, Karur Vysya Bank, Kotak Mahindra Bank, Oriental Bank of Commerce, Punjab National Bank, RBL Bank, South Indian Bank, Standard Chartered Bank, State Bank of India, Syndicate Bank, Union Bank of India, United Bank of India, Vijaya Bank.

No comments:

Post a Comment