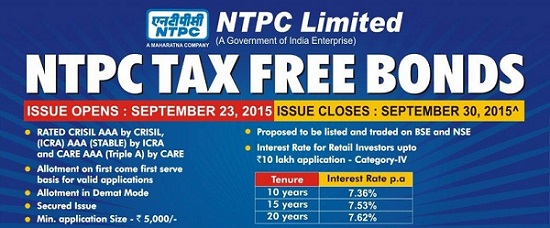

The closing date of the issue was September 30,2015

NTPC's issue was the first tax-free bond issuance in this fiscal 2015-16

NTPC is among the seven state-run entities, including NHAI and IRFC, which have been given permission to raise Rs 40,000 crore in the current fiscal through tax-free bonds.

The NTPC issue had three tenures - 10 years, 15 years and 20 years. For retail investors the coupon or interest rate was 7.36 per cent for 10-year tenure, 7.53 per cent for 15 years and 7.62 per cent for 20 years.

Since the NTPC issue did not attract income tax on interest earned, the effective returns (after factoring in income tax impact) worked out to be higher than comparable rates on fixed deposits for those in higher tax brackets.

For example, India's largest lender State Bank of India currently offers 7.25 % interest on fixed deposits of tenures between 5 and 10 years.

This means for those in the 30 % tax bracket, the effective return works out to be around 5%

On the other hand, the effective returns for those in 30 % tax bracket on NTPC tax-free bonds of 10-year tenure works out to be around 10.3 %

The tax free bonds get listed on stock exchanges to offer exit option for investors. Capital gains made on selling of tax-free bonds on stock exchanges are taxed. If the holding period is less than 12 months, capital gains on sale of tax-free bonds on stock exchanges are taxed as per the tax slab of the investor. If bonds are held for more than 12 months, the gains are subjected to tax rate of 20 per cent calculated after reducing indexed cost of acquisition or 10 per cent of the capital gains without indexation of the cost of acquisition

Note

NTPC is India's largest Power Produce and 6th largest Thermal Power Producer in the World,with Installed Capacity of 41184 MW(including 5364 MW through JV's)

No comments:

Post a Comment