GST or Goods and Services Tax, the upcoming indirect tax regime slated for a July 1 rollout, is expected to bring a slew of surprises to the common man.

Touted as the biggest tax reform since Independence in 1947, GST will subsume all major levies including excise, service tax and VAT or value-added tax.

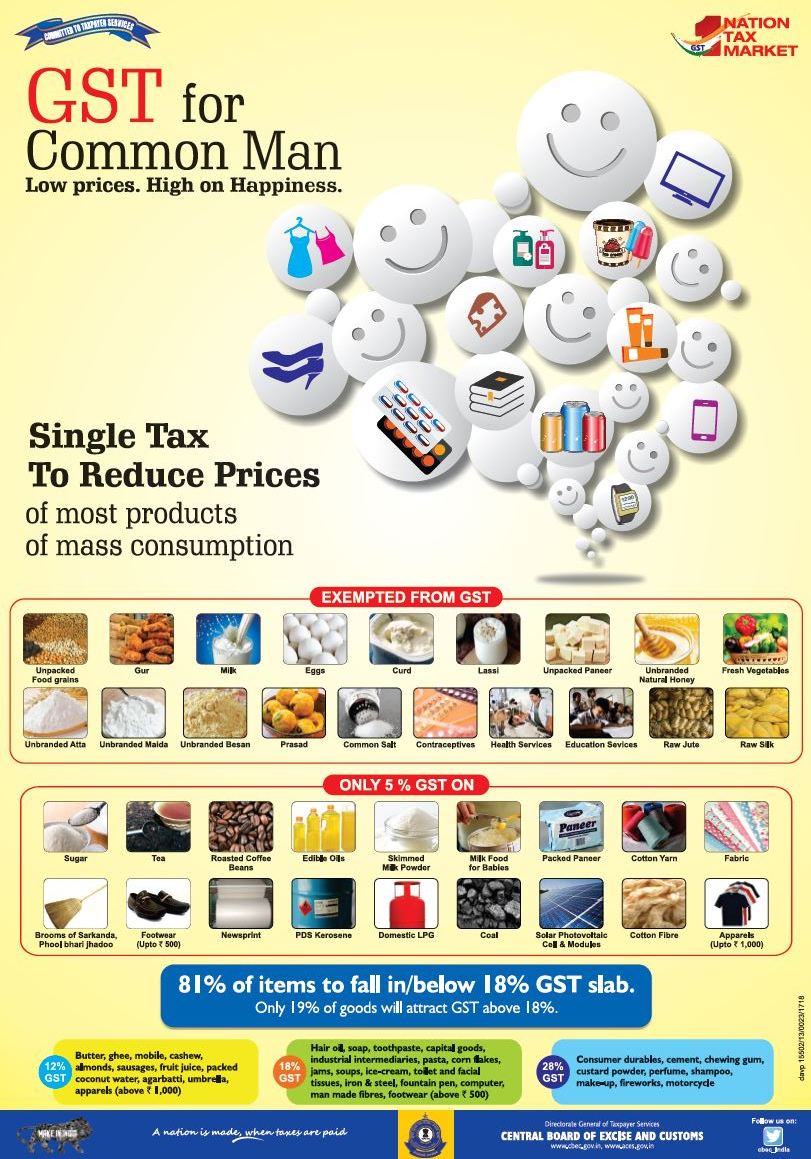

The Central Board of Excise and Customs (CBEC), a part of the Department of Revenue under the Ministry of Finance, has released a list of GST rates - titled "GST for common man" - on everyday items used by the common man.

Items such as unbranded atta/maida/besan, unpacked food grains, milk, eggs, curd, lassi, fresh vegetables and contraceptives are among the items exempted from GST, the CBEC said. "81 per cent of items to fall in/below 18 per cent GST slab.

Only 19 per cent (about a fifth) of goods will attract GST above 18 per cent," it said.

Here's a list of everyday items as given by the CBEC and the tax rate you will have to shell out once GST kicks in

Unpacked food grains, gur, milk, eggs, curd, lassi, unpacked paneer, unbranded natural honey fresh, vegetables, unbranded atta, unbranded maida, unbranded besan, prasad, common salt, contraceptives, raw jute, raw silk

Services exempt from GST

Health, education

Goods attracting 5% GST

Sugar, tea, roasted coffee beans, edible oils, skimmed milk powder, milk food for babies, packed paneer, cotton yarn, fabric, brooms of 'sarkanda' (saccharum bengalense), footwear up to Rs. 500, newsprint, PDS or public distribution system kerosene, domestic LPG, coal, solar photovoltaic cell & modules, cotton fibre, apparels up to Rs. 1,000

Besides, the government also mentioned few items each in the 5, 12, 18 and 28 per cent tax slabs.

12% GST

Butter, ghee, mobile, cashew, almonds, sausages, fruit juice, packed coconut water, agarbatti (incense sticks), umbrella, apparels above Rs. 1,000

18% GST

Hair oil, soap, toothpaste, capital goods, industrial intermediaries, pasta, corn flakes, jams, soups, ice cream, toilet/facial tissues, iron/steel, fountain pen, computer, manmade fibres, footwear above Rs. 500

28% GST

Consumer durables, cement, chewing gum, custard powder, perfume, shampoo, make-up, fireworks and motorcycle

Touted as the biggest tax reform since Independence in 1947, GST will subsume all major levies including excise, service tax and VAT or value-added tax.

The Central Board of Excise and Customs (CBEC), a part of the Department of Revenue under the Ministry of Finance, has released a list of GST rates - titled "GST for common man" - on everyday items used by the common man.

Items such as unbranded atta/maida/besan, unpacked food grains, milk, eggs, curd, lassi, fresh vegetables and contraceptives are among the items exempted from GST, the CBEC said. "81 per cent of items to fall in/below 18 per cent GST slab.

Only 19 per cent (about a fifth) of goods will attract GST above 18 per cent," it said.

Here's a list of everyday items as given by the CBEC and the tax rate you will have to shell out once GST kicks in

Unpacked food grains, gur, milk, eggs, curd, lassi, unpacked paneer, unbranded natural honey fresh, vegetables, unbranded atta, unbranded maida, unbranded besan, prasad, common salt, contraceptives, raw jute, raw silk

Services exempt from GST

Health, education

Goods attracting 5% GST

Sugar, tea, roasted coffee beans, edible oils, skimmed milk powder, milk food for babies, packed paneer, cotton yarn, fabric, brooms of 'sarkanda' (saccharum bengalense), footwear up to Rs. 500, newsprint, PDS or public distribution system kerosene, domestic LPG, coal, solar photovoltaic cell & modules, cotton fibre, apparels up to Rs. 1,000

Besides, the government also mentioned few items each in the 5, 12, 18 and 28 per cent tax slabs.

12% GST

Butter, ghee, mobile, cashew, almonds, sausages, fruit juice, packed coconut water, agarbatti (incense sticks), umbrella, apparels above Rs. 1,000

18% GST

Hair oil, soap, toothpaste, capital goods, industrial intermediaries, pasta, corn flakes, jams, soups, ice cream, toilet/facial tissues, iron/steel, fountain pen, computer, manmade fibres, footwear above Rs. 500

28% GST

Consumer durables, cement, chewing gum, custard powder, perfume, shampoo, make-up, fireworks and motorcycle

No comments:

Post a Comment